Atlas One Investment Platform

Invest and Raise

Capital through

Digital Securities

40+ Investment Opportunities

Real Estate, Mortgages, and Specialized funds

8% to 20+% Expected Returns*

Investments with

Medium to High risk

Low to high liquidity

$75M+

Capital Raised on Atlas One Platform

Thousands of Investors

Building their financial futures from as little as $1,000

Our vision

Our Vision is to bring access, efficiency, and liquidity to private markets through digital technology.

Who we are

We are a digital securities company raising financing for private companies and private funds, and giving investors greater access to private market opportunities utilizing digital technology.

What we do

Atlas One Digital Securities is an Exempt Market dealer. Distributing Private securities to certain elgible investors*

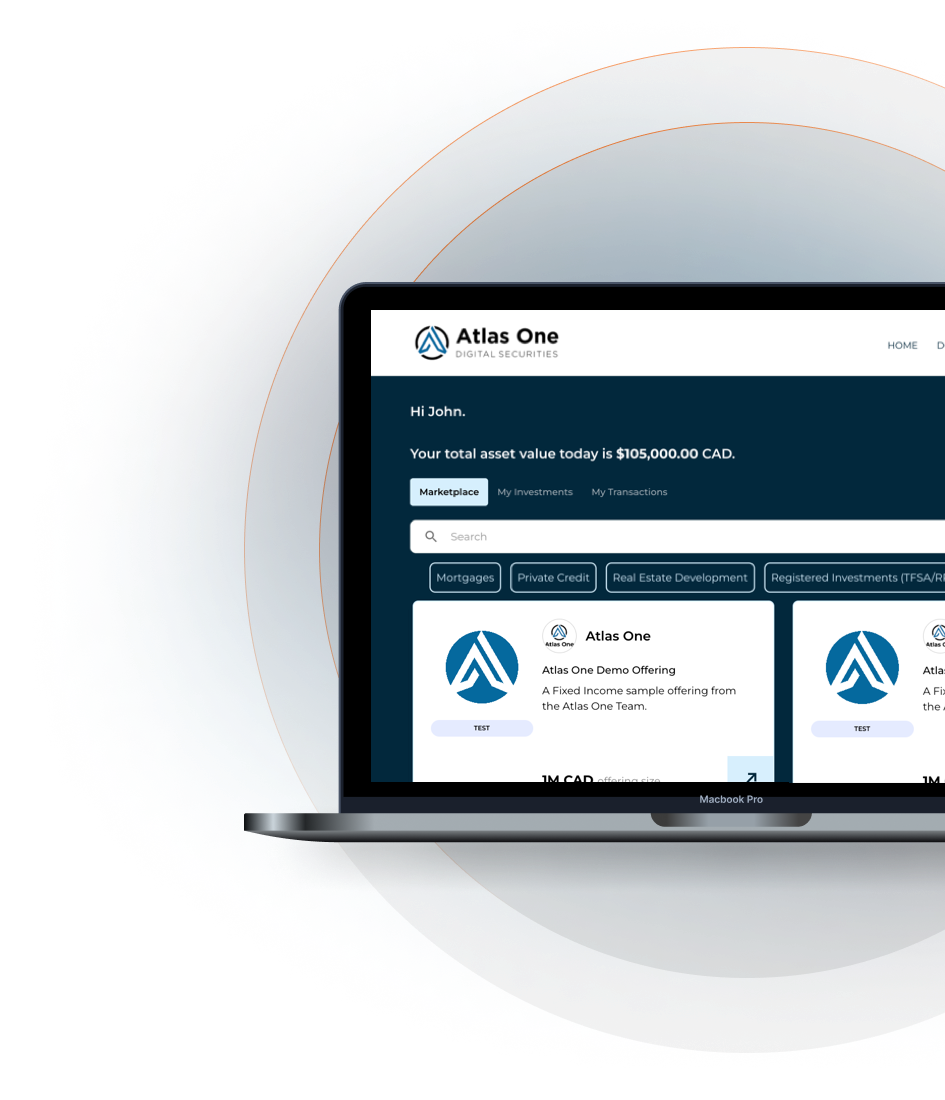

For investors

We provide access to private market investments, that have undergone due dilligence and curation, through our online marketplace

For issuers

We raise capital for private companies and private funds and provide a compliant platform to seamlessly raise capital and manage investors.

For Market participants

For broker-dealers, ATSs and other intermediaries in Canada and abroad, we provide a distribution platform to access investors and Offerings.

Our team

George Nast

Chief Executive Officer

Ambreen Hamza

Chief Operating Officer

Dean Sutton

Director & Strategy Advisor

Darah Powers

Director of Digital Operations

Karim Kawambwa

Technical Lead

Ryan Firkser

Lead Dealing Representative

Vlad Estoup

Dealing Representative

Emmanuel Ideva

Dealing Representative

Subscribe to our newsletter

Stay up to date on the latest news about Atlas One.

By clicking “Subscribe” you agree to receive marketing and promotional materials from Atlas One Digital Securities